Market Overview:

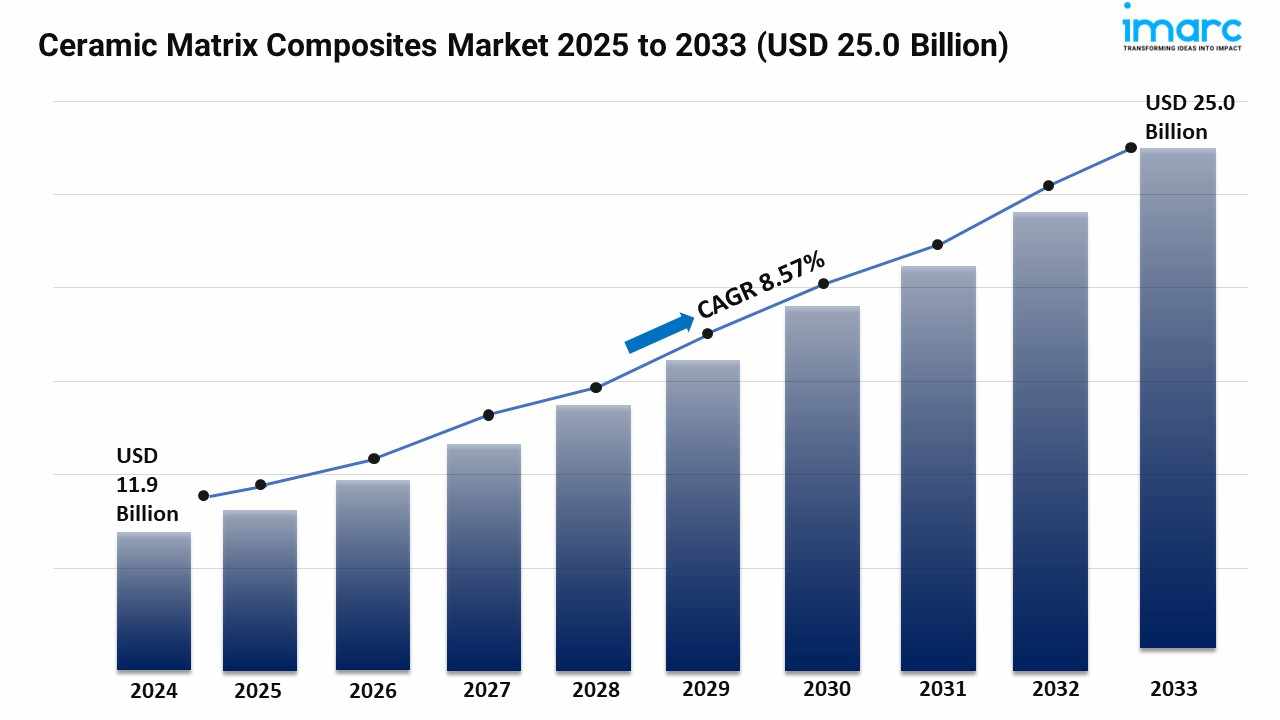

The Ceramic Matrix Composites Market is experiencing significant expansion, driven by Growing Demand from Aerospace and Defense Applications, Increasing Adoption in Automotive Industry for Lightweight Components and Rising Need for High-Temperature Materials in Industrial Applications. According to IMARC Group's latest research publication, "Ceramic Matrix Composites Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033",The global ceramic matrix composites market size was valued at USD 11.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.04 Billion by 2033, exhibiting a CAGR of 8.57% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/ceramic-matrix-composites-market/requestsample

Our Report Includes:

Market Dynamics

Market Trends and Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Ceramic Matrix Composites Industry:

Growing Demand from Aerospace and Defense Applications

Ceramic matrix composites are increasingly utilized in aerospace and defense applications due to their exceptional high-temperature performance, low weight, and superior strength-to-weight ratio compared to traditional metal alloys. In aerospace applications, CMCs are used in jet engine components such as turbine blades, combustor liners, and exhaust nozzles, where they enable higher operating temperatures and improved fuel efficiency. Defense applications include thermal protection systems for hypersonic vehicles, armor systems, and rocket propulsion components. The material's ability to withstand extreme temperatures exceeding 1500°C while maintaining structural integrity makes it invaluable for next-generation aircraft and defense systems.

Increasing Adoption in Automotive Industry for Lightweight Components

The automotive industry is adopting ceramic matrix composites to achieve weight reduction, improved fuel efficiency, and enhanced performance in high-temperature applications. CMCs are being incorporated into brake systems, particularly for high-performance and electric vehicles, where they offer superior heat resistance and reduced weight compared to traditional materials. Engine components, exhaust systems, and turbocharger rotors are also being manufactured using CMCs to withstand higher operating temperatures and reduce overall vehicle weight. As automotive manufacturers face stricter emissions regulations and fuel efficiency standards, the demand for lightweight, heat-resistant materials continues to grow.

Rising Need for High-Temperature Materials in Industrial Applications

Industrial sectors including power generation, metallurgy, and chemical processing are increasingly requiring materials that can withstand extreme temperatures and corrosive environments. Ceramic matrix composites offer excellent thermal stability, corrosion resistance, and mechanical strength at elevated temperatures, making them ideal for industrial furnace components, heat exchangers, and combustion system parts. The energy sector, particularly in gas turbines and nuclear applications, is adopting CMCs for components that require long service life under harsh operating conditions. The material's resistance to thermal shock and chemical degradation makes it superior to traditional ceramics and metals in demanding industrial environments.

Key Trends in the Ceramic Matrix Composites Market

Advancements in Manufacturing Processes and Cost Reduction

The industry is experiencing significant progress in manufacturing technologies aimed at reducing production costs and improving scalability. Advanced manufacturing techniques including chemical vapor infiltration (CVI), polymer infiltration and pyrolysis (PIP), and melt infiltration (MI) are being optimized for more efficient and cost-effective production. Automation and process improvements are making CMC production more economically viable for wider commercial applications. These manufacturing advancements are critical for expanding CMC adoption beyond aerospace into automotive and industrial markets where cost considerations are more stringent.

Development of Next-Generation Materials and Composites

Research and development efforts are focused on creating new CMC formulations with enhanced properties including improved toughness, oxidation resistance, and thermal conductivity. Scientists are developing advanced fiber reinforcements and matrix materials to expand the performance envelope of CMCs. Hybrid composites combining ceramic matrices with different reinforcement materials are being developed for specific applications requiring unique property combinations. These innovations are enabling CMCs to address increasingly demanding application requirements across various industries.

Expansion into Energy and Environmental Applications

Ceramic matrix composites are finding new applications in renewable energy systems and environmental technologies. In concentrated solar power systems, CMCs are used for high-temperature receiver components that withstand extreme thermal cycling. Hydrogen production and fuel cell technologies are incorporating CMCs for their chemical stability and high-temperature performance. Environmental applications including high-temperature filtration and catalytic conversion systems are utilizing CMCs for their corrosion resistance and durability in harsh chemical environments.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging Matrix Composites Market trends.

Leading Companies Operating in the Global Ceramic Matrix Composites Industry:

3M Company

Applied Thin Films Inc.

BJS Ceramics GmbH

COI Ceramics Inc.

CoorsTek Inc.

General Electric Company

Lancer Systems LP

Rolls-Royce Holdings plc

SGL Carbon SE

Ube Industries Ltd.

Ultramet Inc.

Ceramic Matrix Composites Market Report Segmentation:

Analysis by Composite Type:

Silicon Carbide Reinforced Silicon Carbide (SIC/SIC)

Carbon Reinforced Carbon (C/C)

Oxide-Oxide (Ox/Ox)

Others

Silicon carbide reinforced silicon carbide (SIC/SIC) leads the market with around 35.2% of market share in 2024 due to their exceptional qualities such as high-temperature resistance, mechanical strength, and thermal stability.

Breakup by Matrix Material:

Oxide

Silicon Carbide

Carbon

Others

Silicon carbide matrix materials dominate the market as they provide superior thermal conductivity, strength retention at high temperatures, and compatibility with various fiber reinforcements.

Analysis by Fiber Type:

Short Fiber

Continuous Fiber

Continuous fiber leads the market with around 69.4% of market share in 2024 due to its ability to provide improved structural integrity, damage tolerance, and load-carrying capacity.

Analysis by Fiber Material:

Alumina Fiber

Refractory Ceramic Fiber (RCF)

SiC Fiber

Others

SiC fiber leads the market with around 43.1% of market share in 2024 due to its high mechanical strength, thermal stability, as well as its ability to resist corrosion and oxidation.

Breakup by End Use Industry:

Aerospace and Defense

Automotive

Energy and Power

Electrical and Electronics

Others

Aerospace and defense represent the largest end-use segment due to critical requirements for lightweight, high-temperature materials in aircraft engines and defense systems.

Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America leads the market driven by strong aerospace industry presence, significant defense spending, and advanced manufacturing capabilities for high-performance CMC components.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

Write a comment ...